A Mondo Mathematical Meme Massacre

Why hello there, and welcome to Kitchen Catastrophe, where today…I don’t know if this is going to be fun, and it’s definitely only barely about food, but I wanted to eviscerate a couple bad math memes about food I’ve been seeing recently, and went off the rails. This might be the second longest post on the site. That’s where my head’s at. The last like, 5 days have had a SPREE of “people who don’t know how business math works”, including an ACTUAL BUSINESS OWNER, who I had to directly walk through how why the number he THOUGHT he needed was over 4 times more than he did. So if hearing me rant about profit margins, minimum wage, taco meat, and mystery milk sounds like fun, stick around* If not…next week we’ll definitely have food, and any fights we have are almost certainly going to be based on sports, not politics.

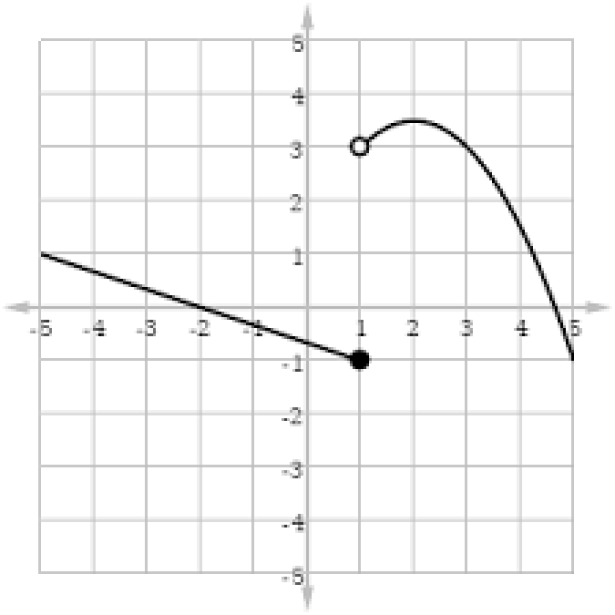

Speaking of, a quick disclaimer/note: one thing that might impact your enjoyment is that I am a college educated, snobby leftist with residual elitism. This is all very much armchair theory work here, which I can only qualify that I am doing with the best of intentions to be as fair as possible. I don’t personally run a business other than this one. I have not been formally trained in business management…much. I have actually had a couple formal classes in like, basic accounting, hospitality and business management, etc. Pricing and selling stock HAS been a part of my job in several fields. I have a robust education in math, best summarized by the criticism given to me in 10th Grade: “Jon, your pre-calc was flawless, your second grade needs work.” For the explanation, I had computed and graphed a function with a jump discontinuity (meaning that, at a certain point, the line hops to a different point, and continues from there. If that sounds weird, imagine trying to graph the cost of buying a bunch of shirts that are “Buy one, get one free”: the line is flat for shirts one and two, jumps up on three, stays flat for for, jumps on five, etc. There’s not a continuous line, because the increase Is not continuous.) and, while I drew the arc of the function correctly…I drew it all one square to the left, because I had MISCOUNTED TO THREE.

Like this, but everything is supposed to the to the right.

So I will be writing this as a way of mathematically disproving some SPECIFIC arguments against raising the minimum wage, on the basis that the math used in them is terrible. That doesn’t mean that there’s not valid reasons a business might oppose the minimum wage, or that the current discussion of raising the minimum wage is targeting the right number or methodology. (For my money, I think it should work more like the UK and some other countries, where the decision to raise the minimum wage is made year-by-year by a panel of economic experts and business leaders, disconnected from the political parties. That way, we don’t go a decade without it going up, and then it having doubling over 4 years to catch up, because that’s going to cause a lot of turbulence in a lot of markets. If everyone knows that the minimum wage will go up somewhere between 0 and 50 cents every year, the math is much easier, and businesses can plan better.) I’m just letting you know you’re not going to see me suggesting tax cuts as a potential part of any of the solutions, and that I’m specifically tearing apart these examples as being garbage.

Good? Good. (Also, just because I forgot to fit it in anywhere else: the business owner understood that he had a 20% profit margin, and that his costs would increase by 18,000. He assumed, therefore, that he would need 90,000 in additional revenue, because 18 is 20% of 90. That’s NOT how profit margin works: a 20% profit margin means your total revenue is 20% more than your costs, not that your revenue has to be 5 times your profit. If his costs increased by 18,000, he’d need 22,500 in new revenue. That’s like someone saying “My house has 5 rooms for 4 members. If I have another kid, I will need to build FIVE MORE ROOMS to make space.”)

The Taco Bell Trifecta

One of the things that really cemented in my head that I was going to have to fight about this was multiple people posting some variant of “If you want a $15 minimum wage, Taco Bell’s going to end up costing as much as a sit down meal”. One even specified “a burrito at Taco Bell is going to cost $38”. (Follow-up: apparently that meme was in fact a quote from a member of Turning Point USA, a conservative activist group, and has been challenged by actual NEWSPAPERS last week, so at least I’m timely with my critiques, eh? Nothing like coming in a week after…the Austin American-Statesman)

The MOST “Newspaper” name I have ever heard a newspaper have.

Now, almost certainly, $38 is meant to be hyperbole. (I hope. I have been rudely surprised to find what I assumed were jokes by Turning Point USA to be entirely serious.) And to explain why, let’s break down how, exactly, business decide how much the thing they sell you costs. For this, I’m going to compare two systems: the MSRP system used by retailers, and more dynamic cost-plus pricing, as you might see in a restaurant.

So, MSRP is very easy to explain. It is NOT the sexually transmitted variant of MRSA, but rather the “Manufacturer-Suggested Retail Price”. For instance, let us say I sell board games and comic books. The comic books often come with a price DIRECTLY PRINTED on them. Meaning I have relatively little lee-way in raising that price without a LOT of customer complaints, or directly putting my price over the printed one, to spite them. When you buy a comic book from Marvel (or, technically, from the distributor), they charge you a certain cost, and say “you should sell this for about $4.” A similar thing happens with board games. A game might cost your shop $40 to buy, and have an MSRP of $75. You can tweak it up or down, but if someone googles how much the game costs at Target, or their local game shop, it’s going to be somewhere in the $70-$75 range barring a sale, so people will be mad if your price is outside what they feel is a ‘reasonable’ difference. So you have to cover your rent, utilities, and employee wages off of that extra $35, and the similar “margins” on all your other products. This is a form of “cost-plus” pricing: you take the cost of the good, add a ratio, and that’s the price. Or the Facts of Life, I don’t remember jingles well.

A more dynamic form of cost-plus pricing is pretty typical in restaurants. How much does a burger cost? Well, you add together the cost of the ingredients, the cost of labor, the cost of overhead (rent, utilities, property taxes, etc), and then add a profit margin. So if it costs me $5 for all the ingredients of the burger, and $5 in labor (say a burger takes 20 minutes of work from someone I pay $15 an hour), my overhead equates to about $5 a burger, and I want to make 20% profit on every burger, my burger should cost about $18. (5+5+5= 15 times 1.2 = 18) There’s wiggle room, where you can tweak some numbers up or down (soda, for instance, tends to cost functionally NOTHING, often only costing a business basically a quarter…so they charge you two or three dollars, with free refills. As long as you drink less than 4-6 sodas, their sodas are 50% profit, which means you can lower the numbers on other items.)

Fries fall under a similar paradigm. You can buy 50 pounds of potatoes for $10, meaning each quarter pound of fries you sell costs you around 5 cents in potato, and probably another 40 cents in labor/activity.

And that’s very useful for this conversation. If a Burrito Supreme currently costs $4.19 in a city like Alexandria, VA, that uses the federal minimum wage, and the minimum wage doubles, how much more will the burritos cost? It depends on the business, but Taco Bell, as with many restaurants and fast-food places, tries to put its cost of labor at around 20-30% of total costs, so let’s assume the high-end. Now, we don’t know the profit margin of the Burrito Supreme, so let’s be STUPIDLY generous, and assume that they’re selling it at-cost. No profit margin at all. So, of that 4.19 cost, about 1.26 of it comes from labor costs. (a more realistic estimate would be under 1.05, which would be the cost if the burrito had a 20% profit margin) Now, let’s further make the (also dumb) assumption that doubling the minimum wage will directly double all labor costs. Yes, apparently the managers and owner were all living on minimum wage too, or refuse to increase their workers pay without increasing theirs by the same ratio. But sure. We add an extra…1.26 to the burrito cost. Now it costs 5.45. That’s it. OR IS IT?!

Technically no, for two reasons: the first is the ripple effect: a minimum wage increase also creates an increase in other facets of the production chain. Like, the farms that grow their beef, or vegetables, or make their dairy could all be affected. The places that make their taco shells could be affected. The companies that SHIP all these products could be affected, etc etc. At least it will if those jobs pay minimum wage. Like, long-haul truckers are typically paid somewhere between $20-40 an hour. They do NOT care that the guys making $7 went up to $15 (other than thinking “maybe I can stop working this job where I am constantly afraid I will run someone over, and sometimes have to resort to drug use to make deliveries on time. Is that worth $5 an hour less?”). They will, at most, see their numbers shift to like, $25-50, in order to keep them happy with their fraught existence.

So we’re clear, that little hatch door on the back? That’s where this guy sleeps. Is $5 an hour worth sleeping in a real bed at night?

And we know this to be true, because here’s a fun trick: San Franciso already has a minimum wage over $15 an hour. You wanna know how much their Burrito Supremes cost? $4.19. Same as a town with the $7.25 minimum wage. Now, their Bean Burrito is $1.99 instead of $1.29, and their Crunchwrap Supreme is $4.49 instead of $4.19…but that REALLY emphasizes how over-blown the $38 number is. That’s a respective cost increase of 0% for the Supreme, 54% for the Bean, and 7% for the Crunchwrap. That’s an average of 20% over all three items, for double the pay. And sure, I’d expect these numbers to go up if the federal minimum wage went up, since interstate commerce helps alter the numbers somewhat: at least one company Taco Bell gets its beef from, and ships said beef around the nation, is based in Wisconsin, where the minimum wage is $7.25. So that’s one part of the chain that isn’t affected by the difference between California’s minimum wage and Virginia, but WILL be affected by a national hike…but the same process goes on for them too: they’re not selling their beef to Taco Bell for a loss, so the cost of their labor must be a factor of their profit margin too, leading to the same math we just did.

The SECOND reason (oh yeah, those last two paragraphs were ONE element is that cost-plus pricing is just the simplest form of pricing, and it’s often considered a BAD form of pricing, because it’s inflexible. In fact, I already GAVE YOU an example of a better form of pricing: the sodas. You don’t price the soda on a strict cost-plus. You price it relative to the market as a whole, and for volume of transactions. Like, if I offered you “a medium soda, $0.40, no refills”, you would be suspicious of me. That number would strike you as low. It legitimately is BETTER for me to charge more, because it’s closer to what you expect.

People’s general reaction if you offer them an entire cake for $5.

And for every person who takes my $1.99 soda and refills it 8 times, there’s going to be 10 who only take the one. Another side of the volume-based pricing is that a minimum wage raise is going to affect everyone, rippling through multiple industries…but by that same token, it means that workers in multiple industries are going to have more money to spend on products, meaning there will likely be an increase in sales. This math gets pretty…not complicated, just tedious, since you’re doing minute variations of the same math several times. Let us look at that Burrito Supreme again. Let’s say, overall, I sell 200 Supreme Burritos a month. 6 or so a day. At $4.19 a burrito, that’s $838 in revenue a month. If I increase the price by the full 1.26, and sell the same amount, I make $1,090 in revenue. But, if I only increase the price by $0.80, and that leads to a 10% increase in sales, my total revenue is $1,097.8. Sure, I make less per burrito, but I make more overall than if I tried for a perfect offset. The risk is trying to predict the sweet spot: if you only get an 8% increase in sales, you end up not making as much.

Now, again, this doesn’t mean that many businesses won’t have legitimate issues with changing the minimum wage. Many stores and restaurants live on razor-thin margins, not supported by corporate infrastructures like Taco Bells are, and plenty of stores feel like they can’t afford to use the more advanced, if slightly risky pricing methods. There is, as I noted earlier, a value to the complaint that we might be changing the minimum wage by too much too quickly. I’m not tearing down any of those stances.

What I WILL, VICIOUSLY, Tear down, is THIS FUCKING MEME.

The Spilled Milk

Yes, THIS is what I invested my mental effort in this week.

The upsetting part is that the majority of the effort is in vocalising the obvious errors: it takes me almost no effort to know this IS cow manure, but it takes me time and energy to EXPLAIN it.

Because EVERY fucking number on here is either wrong or dumb. Milk for most of the country hasn’t been $1 a gallon for 4 or more decades, and only recently dropped that low for a couple regions because Wal-Mart and some other discount outlets are using milk as a competitive loss leader. (Meaning they are intentionally LOSING money on milk, in order to compete with each other, because very few people walk into the store and buy JUST a gallon of milk: you also buy eggs, or cereal, or flour, or whatever. It doesn’t matter, as long as you walked into the store because you knew Milk was $1.)

The federal minimum wage is 7 fucking dollars an hour, not ONE a DAY. Oh, I’m sorry. 1.23 Great. So already, we’re dealing with “imagine you were paid like it was fucking 1880, but the milk prices were set in the 1960s.” Also, Why the fuck are you buying a gallon of milk every day? Why is milk the ONLY THING you buy, since you don’t have money for anything else? (which we will get to in a minute.)

Then, oh boy, your pay goes to 18.45, which is…a number. A very weird number, since it’s more than the current estimate of the average living wage in America (16.54). I THINK they chose it because it’s exactly 15 times more than 1.23, which I guess is to keep it in a 1:1 ratio with the milk cost increase, but…maybe it was meant as a jibe at the fight for the $15 minimum wage. That’s got to be part of it, because 15 is too precise a number to have just come from nowhere…but that kind of implies they think increasing the minimum wage to $15 an hour would multiply it by 15...Do they think people only make $1 an hour right now?

That leads to cost increases, which…alright, we just did this fucking math, so you KNOW that $15 a gallon is almost certainly wrong. A 2 second Google search tells you the industry standard for labor costs in the dairy industry is around 10-15%, meaning that, if the initial price was 1, their employee costs were under 15 cents. Assuming that labor cost increases 15 times, the cost of milk would ACTUALLY end up costing more like an extra $2.50ish. So the milk ends up at $3.50, rendering the rest of this meme invalid, but we have to press on to my favorite two parts!

I didn’t check the rest of the numbers, but I legitimately think the cows may be “paid” more in cost of feed and care. Which honestly makes sense: one of these ‘people’ is making the milk, the other is just extracting and carrying it.

The tax bracket math! There are so many great facets on why this section is dumb:

Those tax brackets don’t exist. Neither of them. At no point in the last 6 years has there been a 23% or a 29% tax bracket, and this meme first appeared around 5 years ago. Hell, the CLOSEST you get is in 2001, we jumped straight from a 15% tax rate to a 27.5%. IN fact, I am fairly sure these two task brackets have NEVER co-existed, and might have never existed, period.

The first tax bracket number is either wrong OR they’ve perfectly undermined their argument for a different reason. Because 23% of 1.23 is 28 cents, meaning that, if the base tax rate is actually 23%, YOU COULD NEVER AFFORD THE MILK. To lose 23 cents off of 1.23 in income, you’d be paying a tax rate of around 18.5%

Interesting detail: in 2014, there was a 25% tax bracket, which started at 36,900, which is, EXACTLY, 2,000 times 18.45, meaning it’s how much you’d make working a full time job at that hourly wage. (the US has 10 federal holidays, so full time workers work the equivalent of 50 work weeks, at 40 hours a week, for a total of 2000 hours) So maybe THAT’s why they targeted that number? Because it’s the cut off for the next tax level? But if so, that just even funnier, because of the NEXT POINT

That’s not HOW taxes work: the US uses progressive income tax brackets, where you pay a given rate for income up to a certain point, and a higher rate on all income over that point. You would never tax the whole 18.45 at 29 percent. Let’s take the wild guess that the magical 23% tax bracket ends at, fuck, I don’t know, 9.28 dollars an hour. Halfway. You’d pay 23% taxes on the first 10 dollars( take home of 7.15), and the 29% on the remaining 8.45, which gives you a take-home of 6.58, for a total of 13.73. And if hitting the next tax bracket is why they picked 18.45, it’s hilarious, because 36,900 is literally the LAST DOLLAR in the 15% tax bracket. You don’t pay the 25% tax until your 36,901st dollar, and only on that one, and all the following ones. But wait, its’ even funnier, because

The Tax bracket shift is completely fucking unnecessary given their dumb premises! Using their fake math (23%) for the initial income tax, you’re STILL unable to afford the milk: your take-home pay is 14.21. You didn’t need to go up a tax bracket at all! (But maybe they did that to distract from point 2. Because using the ACTUAL tax bracket for the initial example (18.5), You DO have JUST enough money, at 15.04)

Somehow, despite all this incompetence, they actually perform their wrong tax math correctly: IF you paid the full 29% tax on all 18.45 dollars per day (oh, right, for some reason we only get criminally low amounts of money PER DAY, not per hour), you WOULD end up with $13.10, unable to afford your $3.50-SORRY, “$15” milk.

And finally: Okay, so we have this weirdo who’s working at slave wages and only buying a gallon of milk a day…how does this help the government at all? Like, the government wants you to be relatively healthy and productive, to own property and work and engage in commerce and make families, all of that. This person is a worst case scenario for the government. Someone they have to pay to clothe and feed and house. They’re gonna have to give them FOOD STAMPS for THE MILK. And they definitely have to go fucking sue this employer about this whole 1.23 a day business. (Unless, even more tragically, this person is disabled, or a student, since both of those groups can be paid under the minimum wage, the latter for work experience/loan displacement, the former…so they can have a job, despite reduced productivity from their disability. (Though, as a note, they have to be paid at a rate commensurate to their lost ability. So you’d have to make the argument that this person is…47 times less productive than a normal worker.))

Did you hire Stephen Hawking to be a Stock Boy? Like, how the hell do you find someone 47 times less productive than most people? You are clearly putting that person in a terrible position.

It is…a masterpiece of malevolent milk-based mathematical misuse. And hopefully I’ve tired my self out ranting about it, because I have a weirdly busy day today, and this has already gone on much longer than I intended.

MONDAY: WE WERE SUPPOSED TO HAVE A MEETING! DAMN IT. LIKE I SAID: PROBABLY CUBANOS. THOUGH, WHAT I MIGHT HAVE TO DO IS SPLIT THE THREE RECIPES OVER THE WHOLE WEEK: BREAD AND MEAT MONDAY, SANDWICH THURSDAY. WE’LL SEE.

THURSDAY: IF I DON’T SPLIT UP THE RECIPES, WE’LL PROBABLY TALK ABOUT THE MOVIE CHEF, OR THE WEIRD THINGS I DISCOVERED WHILE GOOGLING TAMPA FOODS.